Tax incentives for green energy investments: what you need to know

Anúncios

Tax incentives for green energy investments provide financial benefits that encourage the adoption of renewable technologies, helping individuals and businesses save money while promoting sustainable development and reducing environmental impact.

Tax incentives for green energy investments are becoming increasingly important in today’s economy. They not only support environmental initiatives but also present financial advantages for individuals and businesses alike. Curious about how to take advantage of these opportunities? Let’s dive in.

Anúncios

Understanding tax incentives for green energy

Understanding tax incentives for green energy is crucial for anyone looking to invest in sustainable technologies. These incentives make green energy more affordable while helping to protect the environment. It’s a win-win situation that both homeowners and businesses can benefit from.

Many people are unaware that there are different kinds of tax incentives available. These include credits, deductions, and rebates that can lower the overall cost of installations. Knowing how these incentives work can help you maximize your savings.

Anúncios

Types of Incentives

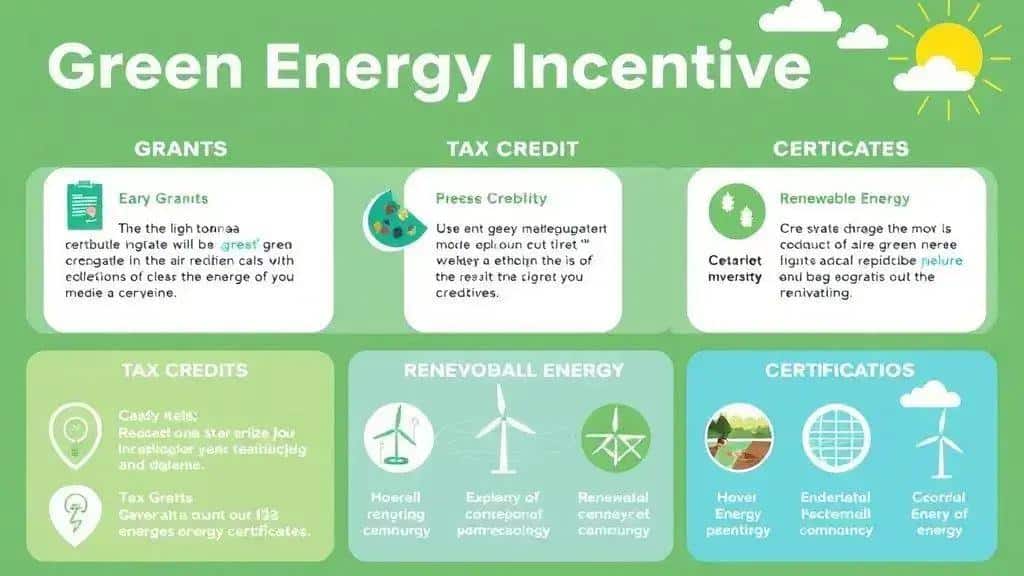

The main types of tax incentives for green energy investments include:

- Tax Credits: These directly reduce the amount of tax owed, making them very beneficial.

- Tax Deductions: These allow you to deduct a portion of your investment from your taxable income.

- Rebates: These are cash payments offered by governments or organizations after the equipment is installed.

Understanding which incentive applies to your situation is key. For instance, residential solar energy installations can often qualify for the federal solar investment tax credit (ITC). This allows homeowners to claim a percentage of their solar costs as a tax credit on their federal return.

In addition to federal incentives, many states and local governments offer their own programs. These might include grants or additional tax credits, making clean energy even more appealing.

Why Tax Incentives Matter

The importance of tax incentives cannot be overstated. They increase the adoption of renewable energy solutions, which can lead to significant reductions in greenhouse gas emissions. When more individuals and businesses invest in sustainable technologies, the positive impact on the environment grows exponentially.

Moreover, by participating in these programs, investors can enjoy a quicker return on investment (ROI). Understanding how to leverage these tax benefits is essential for anyone considering green energy projects.

Types of incentives available

When exploring types of incentives available for green energy, it’s essential to understand the options at your disposal. These incentives are designed to make the transition to renewable energy more accessible and economically viable.

There are several categories of incentives that individuals and businesses can tap into. Each type serves a unique purpose and can offer significant financial relief on investments in green technologies.

Grants and Funding

Many organizations provide grants to support renewable energy projects. These funds do not need to be repaid and can significantly offset installation costs. Often offered by governmental bodies, grants aim to spur growth in the renewable sector.

- Federal Grants: These are provided by the federal government for various renewable energy initiatives.

- State Grants: Local states often have their own programs aimed at promoting energy efficiency.

- Utility Grants: Some utility companies offer incentives to customers who install renewable energy technologies.

In addition to grants, another significant incentive is tax credits. These credits reduce the amount of tax owed directly and can be incredibly valuable for maximizing the financial feasibility of projects.

Tax Credits

The most popular type of tax credit is available for solar installations. By taking advantage of the federal solar investment tax credit (ITC), homeowners can claim a percentage of their solar costs, greatly improving their ROI. This credit not only decreases tax liability but encourages more people to adopt solar energy.

Moreover, some states have their own state tax credits that can be combined with federal credits, providing even greater benefits. Knowing how to navigate these can save you thousands.

Renewable Energy Certificates (RECs)

Additionally, consumers can earn Renewable Energy Certificates (RECs) when they produce their own renewable energy. These certificates can be sold on the market, providing an extra income stream to homeowners or businesses participating in renewable energy generation.

How to apply for green energy tax benefits

Understanding how to apply for green energy tax benefits can simplify your journey toward sustainable investments. The application process may seem daunting, but breaking it down can help.

To start, gather necessary documentation related to your green energy installation. This typically includes proof of purchase, installation receipts, and any relevant permits. Having these documents ready is crucial for a smooth application process.

Steps to Apply

Here are the key steps to follow when applying for these benefits:

- Research Eligibility: Before you apply, ensure you understand the specific tax incentives available in your area.

- Complete the Required Forms: Tax forms differ based on the type of incentive. Familiarize yourself with the IRS forms or state-specific applications.

- Consult a Tax Professional: Seeking advice from an expert can help clarify complexities in the application process.

- Submit Your Application: Pay attention to submission deadlines for tax credits and incentives, as they vary by program.

After submitting your application, keep track of its status. Some programs allow you to check online, making it easier to confirm your submission is complete.

Many taxpayers overlook local and state incentives. Don’t forget to investigate if your state offers additional programs that can complement federal benefits.

Helpful Resources

Numerous resources are available to assist you through this process. Websites dedicated to renewable energy often provide step-by-step guides or links to application forms. Local utility companies may also have information on specific benefits they offer.

By following these guidelines and utilizing available resources, applying for green energy tax benefits becomes much more manageable. You’ll be closer to enjoying the financial rewards that come with sustainable energy investments.

Impact of incentives on sustainable development

The impact of incentives on sustainable development is significant and multifaceted. By encouraging the use of renewable energy sources, these incentives help not only individual homeowners and businesses but also contribute to broader environmental goals.

When people and companies take advantage of tax incentives, they often invest more in clean technologies. This increased investment leads to the growth of the green energy sector. With more options available, the public can choose energy sources that have less environmental impact.

Benefits of Renewable Energy Incentives

Here are some key benefits derived from these incentives:

- Reduction in Greenhouse Gas Emissions: By adopting renewable energies, communities can decrease their carbon footprint, contributing to a healthier planet.

- Job Creation: The growth of the green energy sector often results in new job opportunities in installation, maintenance, and manufacturing.

- Boosting Local Economies: Renewable energy projects can drive economic growth, particularly in rural areas, by creating demand for local services and products.

Moreover, tax incentives can facilitate a quicker transition to renewable energy sources. For example, when homeowners invest in solar panels with the help of federal tax credits, they often see significant energy savings over time.

Encouraging Sustainable Practices

Incentives also encourage sustainable practices beyond just energy use. As more people invest in energy-efficient appliances and home upgrades, they often adopt other eco-friendly behaviors. This shift contributes to a more sustainable lifestyle overall.

Furthermore, the positive effects are not limited to the environment. Communities that embrace green technologies often experience improved public health due to reduced air and water pollution. By promoting clean energy investments, incentives play a critical role in fostering a healthier future.

FAQ – Frequently Asked Questions About Tax Incentives for Green Energy Investments

What are tax incentives for green energy?

Tax incentives are financial benefits provided by the government to encourage investments in renewable energy sources, such as tax credits and deductions.

How can I find applicable tax incentives for my renewable energy projects?

You can check federal, state, and local government websites for available programs, or consult a tax professional specializing in green energy.

What types of projects qualify for green energy tax incentives?

Projects like solar panel installations, wind turbines, and energy-efficient home upgrades often qualify for various tax benefits.

How do tax incentives impact sustainable development?

Tax incentives promote the adoption of renewable energy, reduce greenhouse gas emissions, and contribute to job creation in the green sector.